What is asset tokenisation and why does it matter? Learn more from experts at CRYPTO2030. Asset tokenisation is currently a leading narrative in crypto, sometimes referred to as RWA (real world asset) tokenisation.

In the Web3 world, asset tokenisation stands out as a revolutionary concept with the potential to reshape investment landscapes and democratise access to wealth. Virtually any asset – ranging from real estate to art to stocks – could potentially be tokenised. Keep reading to learn more about how asset tokenisation works, discover use cases, and uncover the challenges around asset tokenisation.

What is Asset Tokenization?

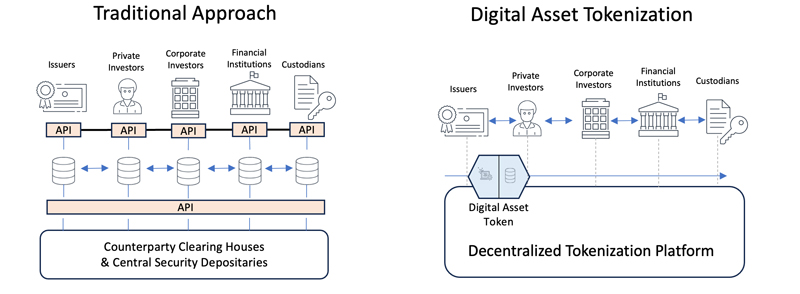

Asset tokenisation refers to the process of converting rights to an asset into a digital token on a blockchain. Essentially, asset tokenisation breaks up ownership from one large piece into many smaller pieces. These tokens can represent real-world assets such as artwork, collectibles, and land. They can even represent intangible assets such as real estate and stocks. Tokenising assets makes them more accessible and tradeable on digital platforms. The concept promises enhanced liquidity, transparency, and efficiency, opening up new avenues for investment in assets that were previously out of reach (whether monetarily or practically) for the average investor.

By using blockchain technology, asset tokenisation ensures that when you acquire tokens representing an asset, there's no centralised authority that can modify or revoke your ownership. The immutability of blockchain means your ownership of the asset is immutable and nobody can take the asset away from you.

If this concept sounds familiar to NFTs, it’s because NFTs are actually a type of tokenised asset. The other type of tokenised assets are called fungible tokens, which are interchangeable and divisible, unlike NFTs. For example, cryptocurrencies like Bitcoin and Ethereum are examples of fungible tokens. If you trade one Bitcoin for another, you still have one Bitcoin of equal value, just like trading one dollar bill for another dollar bill.

Coming Up:

This article is part 1 of a 3 part series on asset tokenisation, recapping our panel at CRYPTO2030. In the next section, we'll dive deeper into the challenges of asset tokenisation.

To read the rest of the series, check out part 2 and part 3:

- Use Cases and Challenges of Asset Tokenisation in Global Wealth and Asset Distribution (Part 2 of 3)

- Use Cases and Challenges of Asset Tokenisation in Global Wealth and Asset Distribution (Part 3 of 3)

Meet the experts behind our "Web3 Governance" panel

At CRYPTO2030, the brightest and most innovative minds in Web3 came together to exchange ideas and propel the advancement of the Web3 space.

Follow our panellists to stay up-to-date on what they are working on: