Welcome to part 3 of our series about asset tokenisation, recapping our panel from CRYPTO2030. In this concluding section, we explore the future potential and diverse use cases of asset tokenisation, as well as the critical steps for tokenisation processes. From transforming investment opportunities to democratising access to assets, we delve into how digital tokens are poised to reshape the future of finance.

OpenEden

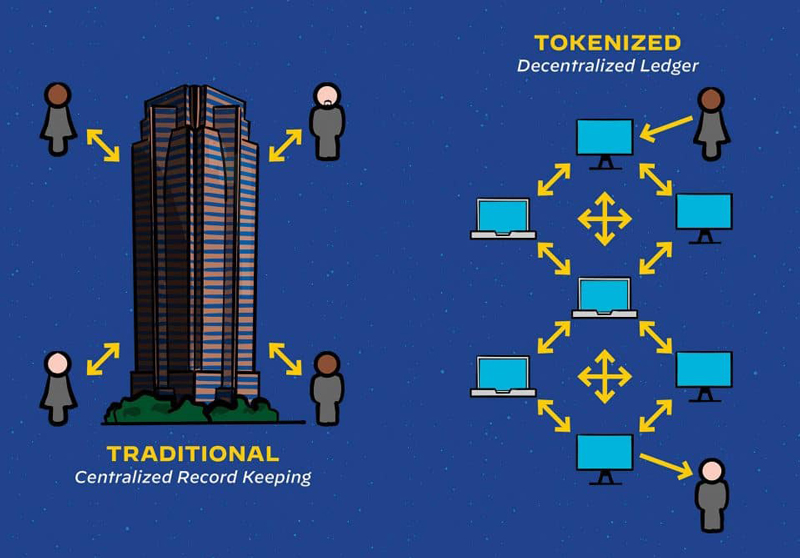

In OpenEden's approach to asset tokenisation, the model revolves around creating an on-chain vault, designed under the Ethereum Improvement Proposal (EIP) 4626. This innovation addresses the complexities and inefficiencies associated with traditional investment in mutual funds, such as those offered by Fidelity or BlackRock. Traditional investments typically involve cumbersome onboarding processes, with long wait times for wiring funds and transaction settlements. The complex processes increase costs and potential risks.

OpenEden's model streamlines this process by eliminating the need for multiple intermediaries. This is achieved through the power of blockchain and smart contract technologies, offering a more direct, peer-to-peer transactional method. The focus is particularly on tokenising the US Treasury market, which is a widely trusted low-risk investment option.

OpenEden’s tokenisation of US Treasury Bills aims to make these assets more accessible, especially to investors in regions where access to US Treasury bills may be restricted due to governmental regulations. By tokenising these securities, OpenEden not only opens up a massive market for global investors but also simplifies the legal and transactional framework, making it easier to understand and more trustworthy.

Real estate

Our panellist Alexander Filatov described how asset tokenisation could be used for real estate investments, using the city of Belvedere as an example: “Imagine I'm just walking around in Davos, and I see Belvedere. I believe in the fantastic model of Belvedere because they're making a lot of money during Davos. There is no way you're going to buy part of Belvedere. But imagine if it's tokenized and you can take your phone and purchase 0.001 percent of it. Of course, this is not possible today due to legal challenges. But in the long-term future it could be the case that through your portfolio on the phone you can just buy any real estate in the world”.

Here is an example of the potential structure behind real estate tokenisation:

Real world events

The concept of asset tokenization extends far beyond the digital realm, bridging the gap between tangible assets and blockchain technology. An example is the tokenisation of Porsche racing events. In this model, token holders not only possess a digital asset but also share in the tangible value of a Porsche, specifically its performance and heritage in the racing season. This approach exemplifies the potential of tokenisation to enhance engagement and investment in traditional sectors like sports by integrating them with blockchain technology.

Further expanding the scope of tokenisation, the project advocates for inclusion – while most people wouldn't be able to afford a Porsche, they could participate in the ownership of a Porsche through tokenisation. Tokenisation democratises access to assets that are normally difficult to obtain, allowing individuals to engage in activities or investments they are passionate about, regardless of their initial capital.

The Comprehensive Process of Asset Tokenization

The process of bringing a tokenisation project to fruition involves addressing several critical components:

- Legal framework: Navigating the complexities of legal requirements is crucial. The tokenisation of assets is a technological process and also a legal one, requiring thorough compliance with applicable laws and regulations to ensure the legitimacy and security of the tokens.

- Technical infrastructure: Developing a platform that can tokenise assets is a time-intensive task that involves programming the blockchain infrastructure to support the technology. This step is crucial for creating a secure environment for issuing and managing tokens.

- Security compliance: Ensuring the token meets high-security standards is essential. This involves rigorous testing and optimisation to protect against vulnerabilities, safeguarding investor interests and the integrity of the token.

- Formulating tokenomics: tokenomics is the cornerstone of tokenisation. For a tokenisation project to succeed, specific procedures such as how the tokens will be divided and distributed, as well as the price and smart contract technology needs to be created.

- Marketing and investor relations: A critical aspect of asset tokenisation is the development of a comprehensive marketing strategy and investor relations plan. Engaging potential investors and maintaining transparent communication is key to securing investment and ensuring the long-term success of the token.

Conclusion

The asset tokenization panel at CRYPTO2030 shed light on the transformative potential of digital tokens to democratise access to investment opportunities. Despite the challenges ahead, the consensus among experts is clear: it is not a question of if widespread adoption of tokenisation will happen, but when.

As the regulatory and technological landscape continues to evolve, asset tokenisation is poised to become an essential part of the future financial ecosystem, making previously inaccessible assets available to a broader audience and driving innovation in the global market.

Meet the experts behind our "Web3 Governance" panel

At CRYPTO2030, the brightest and most innovative minds in Web3 came together to exchange ideas and propel the advancement of the Web3 space.

Follow our panellists to stay up-to-date on what they are working on: